About Us

Comprehensive Solutions in the Modern Business Environment.

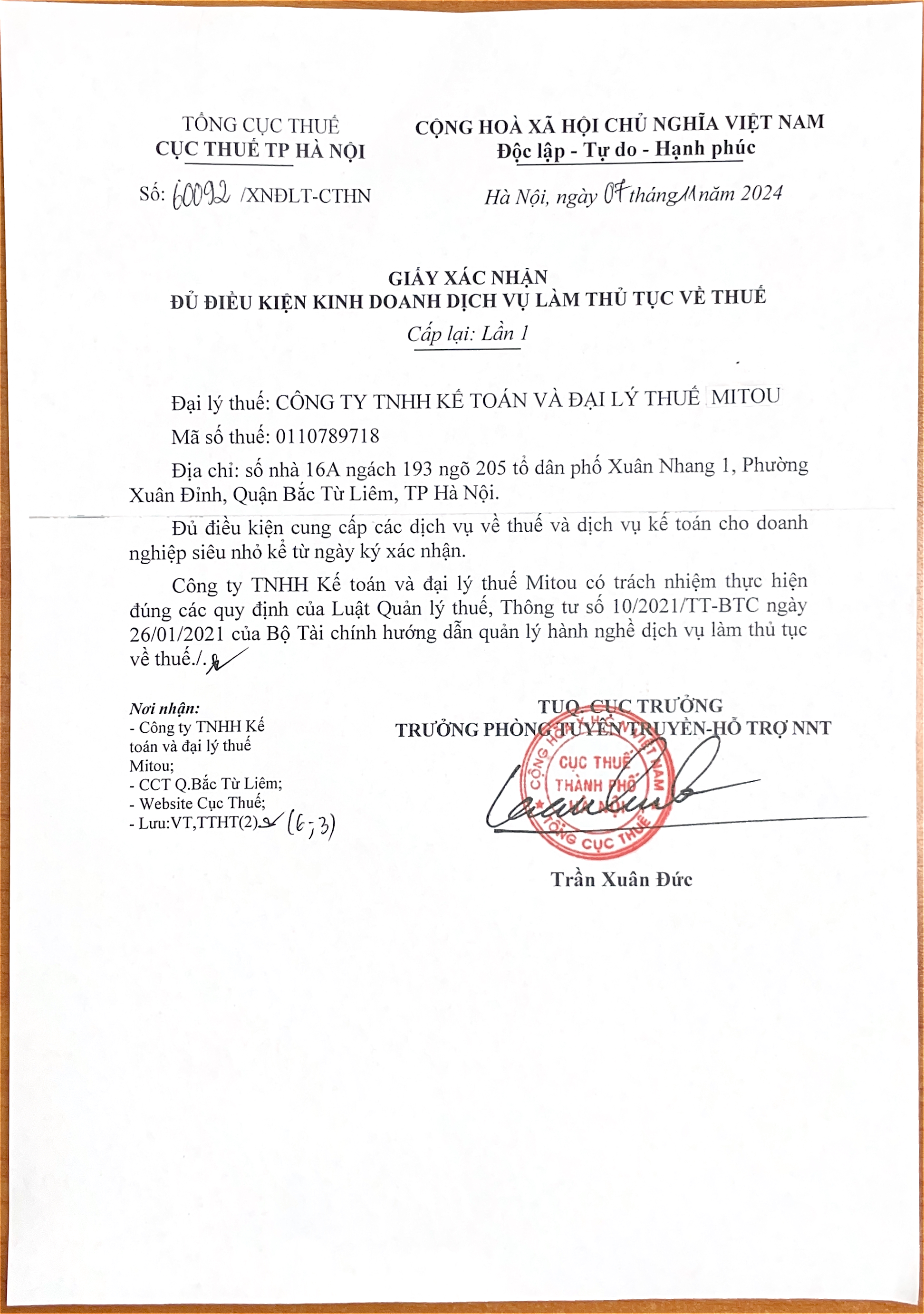

The initial Tax Agent License No. 46651/XNĐLT-CTHN and the first reissued license No. 60092/XNĐLT-CTHN, issued by the Hanoi Tax Department, authorize us to provide tax and accounting services for businesses.

Standards

Accuracy

Thoughtfulness

Responsibility

Trusted

Global Customers

+

Updated Document

+

Utility

+

Customer

MitoU Accounting and Tax Agent – A Comprehensive Solution for Businesses in the Modern Business Environment

In a competitive business landscape and with increasingly stringent tax management through technology by government agencies, businesses are required to comply with regulations, optimize costs, and operate efficiently. Understanding these needs, MitoU Accounting and Tax Agent offers a comprehensive service under the motto “Standardized – Accurate – Attentive – Responsible,” helping businesses optimize their financial and tax operations, mitigate risks, and focus on core production and business activities.

Advantages of MitoU's Tax Accounting Services for Businesses

1. Standardized – Fully compliant with legal regulations

MitoU ensures that all accounting and tax processes strictly adhere to current legal regulations. We continuously update new tax policies, particularly in the context of increased regulatory oversight of invoice usage, tax declarations, and the adoption of e-invoices.

2. Accurate – Minimizing tax-related risks

The experienced professionals at MitoU, with their deep understanding of tax regulations, assist businesses in:

Accurately and timely completing tax procedures.

Avoiding errors that could lead to legal risks or penalties.

Ensuring transparent, truthful, and reliable accounting data and financial reports.

3. Attentive – Dedicated service, accompanying businesses

MitoU is committed to delivering the highest level of customer satisfaction by:

Providing comprehensive services tailored to the needs and scale of each business.

Offering thorough consultation and resolving all financial, accounting, and tax-related issues.

Always being ready to support businesses at every stage of their development.

4. Responsible – Ensuring peace of mind for businesses

With a strong sense of responsibility, MitoU not only helps businesses comply with legal regulations but also aims to protect their legitimate rights and interests before regulatory authorities. We reduce your financial and tax burdens so you can focus entirely on your core production and business activities.

Reasons to Choose MitoU Accounting and Tax Agent

Save operational costs.

Minimize tax risks.

Focus on core business activities with peace of mind.

Let MitoU Accounting and Tax Agent become your strategic partner, helping your business overcome challenges, seize opportunities, and achieve sustainable growth.

Contact us today to receive the most optimal solutions for your business!

"MitoU – Standardized, Accurate, Attentive, Responsible – Partnering with your growth."